Markets are at all time highs – this is not uncommon – markets (since they are supposed to go up) should be at, or near, all time highs much of the time. That doesn’t mean that investors cannot be nervous about this condition. A number of respected investors will encourage caution, citing “all-time highs” as a reason for caution. The worry, of course, is that the market will come crashing down.

(SPY at all time highs right now!)

Long short strategies, which have both long, and short positions are a nice way to hedge against the potential of a large market downturn. When engaging in a long short strategy, the first decision to make is are you going to be completely hedged (that is, your long positions and short positions are roughly equal, in terms of market sensitivity), or are you going to have a long or short bias. This is ultimately a decision that resolves into the question, “can you time the market?” There are many perspectives on this, but my take is that this is hard to do and I am not going to focus on this.

Rather, I will focus on a question that arises once you have decided on a net exposure: what should you be long? and what should you be short? Some solutions include:

1. Going long and short completely separate strategies – for example, profitability for a long strategy and some short screen for a short. This has the advantage in that you are, at least in back tests, gaining on both ends. However, we know nothing about the correlations of the long and short legs and there may be situations in which we lose money on both ends if the long leg goes down and the short leg goes up!

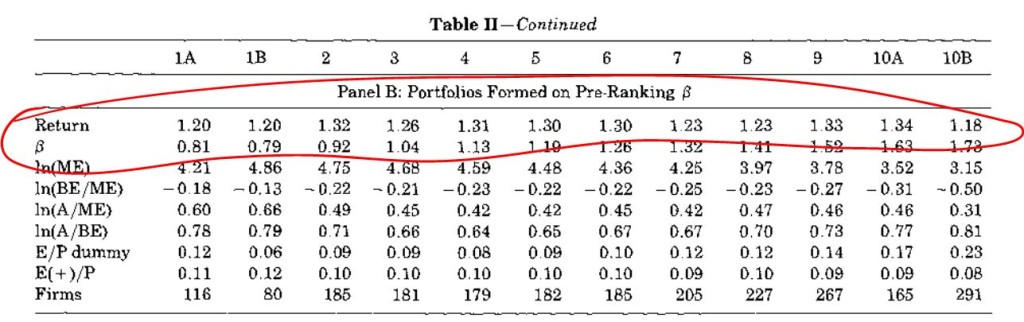

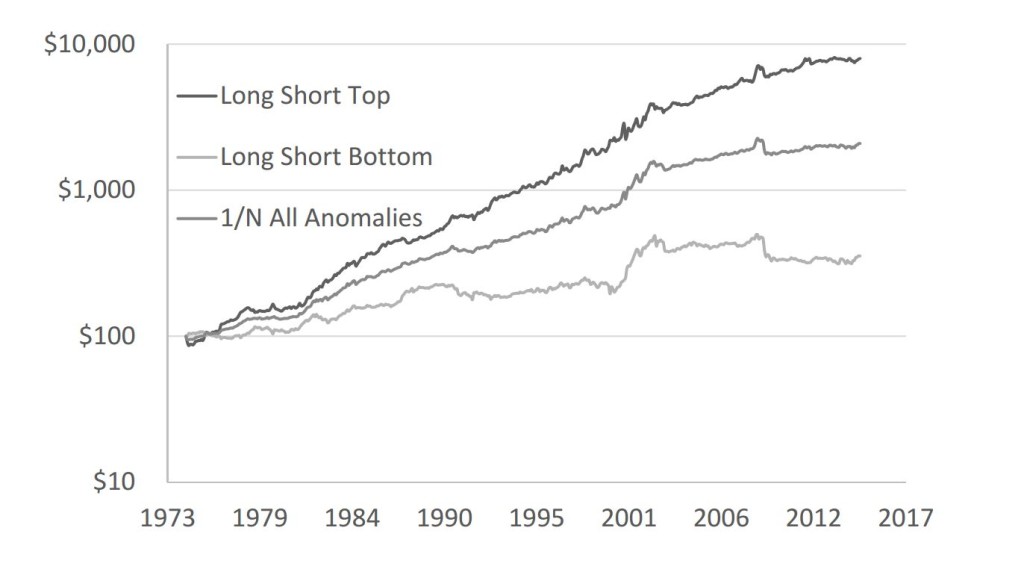

2. Going long and short separate ends of a single spectrum. For example, if we are separating stocks in the universe based on the PE measures, perhaps we go long low PE stocks (value stocks) and short high PE stocks (growth stocks).

(Value – top line, growth, bottom line – we would make the difference in a long short strategy)

This has some advantages over the first technique, in that the stocks are otherwise likely to be similar in long and short legs, and hence the correlations should be high – thus the hedge from the short leg should work better. Also, this is the standard way in which academics document characteristics of stocks that affect future returns – so there is a lot of literature and data easily available under this framework.

3. Going long something that’s “good” and being short the market. This is the most common way industry practitioners seem to run long short portfolios. Their long legs are driven by their proprietary research and secret signals but on the short side, they simply use the market. The real advantage to this is that from a practitioners perspective, shorting the market is much, much easier than shorting a collection of stocks. There is infinite liquidity in market indices and you never have to be worried about getting a locate.

These are just three possible ways to implement a long short strategy. Each with its own advantages and disadvantages. They are definitely psychologically useful when investing in markets that are at “all time highs,” but there’s no reason to restrict their use to such situations – they can be used any time you want to a hedge against potential large downturns in the markets.