The January Effect refers to the observation that stock returns appear much higher in January than other months. There’s a beautiful wiki on the effect ( https://en.wikipedia.org/wiki/January_effect ) so I won’t go into much detail on it, except to say that:

1. The first thing that came to my mind regarding this effect is taxes – people sell in December to harvest tax losses/gains and then rebuy in January

2. From my understanding, this effect may no longer exist – papers come out both ways on this with recent data.

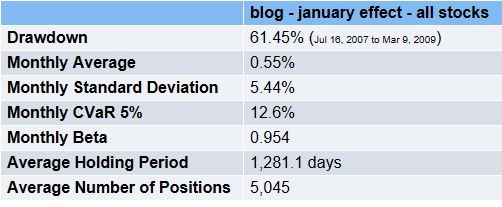

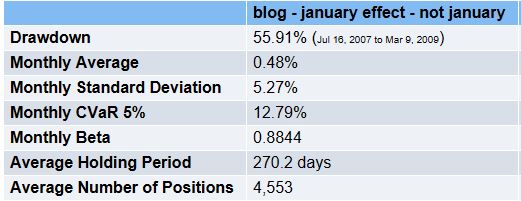

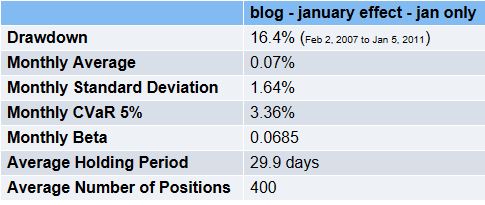

3. Here’s what Equities Lab has to say about the issue.I ran three backtests – all used data from Jan 1 2000 to today, had a monthly rebalance over all stocks (including illiquid small stocks) – the first does all months, the second does all months except January and the third does January only.

To compare the three, we can normalize everything to 12 month returns –

All months annual returns = 1.0055^12 –> 6.8%

Non January returns = (1.0048^(12/11))^12 –> 6.5%

January only returns = (1.0007^(12/1))^12 –> 10.6%

In light of this evidence, I think there’s a case to be made that some version of the January Effect still exists.